AMR Press

The Luxury Investment Index 2021: Covid-19 had a huge logistical impact on the global marketplace for luxury investments in 2020

March 2, 2021 / Knight Frank / The Wealth Report

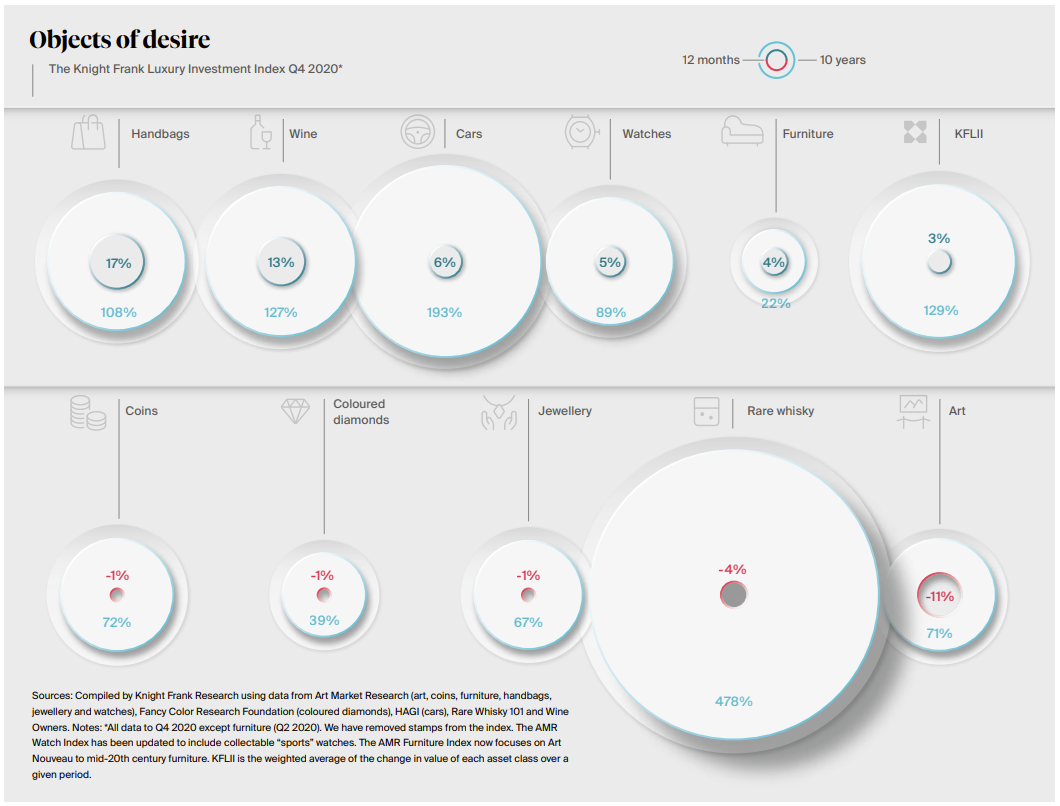

Hermès handbags once again topped the Knight Frank Luxury Investment Index (KFLII) with prices rising by 17%, according to our index compiler AMR. An established online auction presence and the appetite for relatively affordable luxury pick-me-ups during the Covid-19 pandemic, particularly in Asia where many bag collectors are based, helped the asset class retain pole position.

Art The art market, however, did not fare quite so well with the auction-tracking AMR All Art Index dropping 11% in 2020. But with so many factors impacting the market, there was no single reason for the fall in average values, says AMR’s Sebastian Duthy. “For obvious reasons one of the biggest changes was a shift towards private sales at the major auction houses. The volume of all sales that were publicly auctioned at Sotheby’s and Christie’s last year was down 26% and 46% on 2019, respectively. The problem was compounded by the slowing in supply of quality works as consigners who could afford to wait preferred to sit it out at home.” But, points out Duthy, there was still plenty of enthusiasm from buyers. “With a new emphasis on home working, there was a surge in demand from collectors sprucing up their homes.

By the second half of the year, a new kind of auction sale had emerged, catering to this need with eclectic showcases mixing art, antiques and collectibles.” While traditional collectors’ tastes have been driven by art history, newer collectors are just as likely to be turned on by what’s trending on social media, and this shift H continued under lockdown, he adds. “Although the number of individual artist records halved last year compared with 2019, most of the winners were young artists, increasingly referred to as ‘Red Chip’. “Tokyo-born Ayako Rokkaku, who paints candy-coloured figures and rainbow[1]like smears, and the young American neo[1]surrealist painter Emily Mae Smith, had sales that tripled or quadrupled their high estimates. Three works by Matthew Wong, who was barely known before his premature death in 2019, broke through the million-dollar mark. “Many of these ‘Red Chip’ artists have become so popular with collectors in Hong Kong that auction houses are increasingly pivoting their sales in this direction.”

How the art industry evolved due to the global health crisis

February 19, 2021 / by Jo Caird

The art world was better prepared for the coronavirus pandemic than many other sectors. Though local and national lockdowns forced galleries to close their doors and leading auction houses to cancel in-person sales – including some of the most important dates in the global art calendar – a swift pivot to online activity helped protect the art market from some of the worst ravages of COVID-19.

It has not escaped entirely unscathed, though. From January to September 2020 there was a 20.2 percent drop in the number of paintings sold at auction, compared to the same period the previous year, according to analysis by Art Market Research Developments (AMRD).

With many auctions postponed in the first few months of the pandemic, there were simply fewer opportunities to trade, Sebastian Duthy, AMRD’s chief executive, told World Finance. As auction houses honed their online offer and buyers were able to return to the market, the outlook improved.

“If you had asked me a few months ago, I would have painted a much gloomier picture,” Duthy said. “If you look to the figures in July 2020, it looked much worse than what it was.” All in all, the impact of the pandemic on the market “is not as bad as one might expect,” said Duthy, offering as a comparison the period immediately following the 2008 financial crash, which saw a 26.6 percent fall in the number of paintings sold at auction compared with the previous year.

A buyer’s market

It’s not just the number of sales that has decreased but the value of those sales too, with AMRD’s All Art Index noting a fall of 8.5 percent in the average value of fine art objects (paintings, sculpture, prints and photography) sold at auction from January to September last year. This is partly down to the fact that the pandemic has created a buyer’s market, with reports of the phrase ‘COVID price’ being bandied around in art market circles. It’s also a by-product of the loss, for the moment at least, of the often glitzy in-person sales that have historically attracted the biggest ticket items.

“People want to be able to inspect what they’re buying. Of course technology finds ways to make it feel like you’re actually looking at the real thing and give people confidence that they are buying something of great quality, but nothing beats kicking the tyres yourself and having a close look,” said Duthy.

The analyst expects the market to bounce back as in-person sales are gradually allowed to resume and confidence returns, most likely in the second quarter of 2021. Even after that happens however, auction houses are highly likely to continue to benefit from increased online activity. The leading auction houses have had an online presence for a long time now with Sotheby’s first collaborating with online auction portal eBay in 2002 and Christie’s launching a live online viewing room in 2006. But the pandemic forced them to up their game, investing in new platforms to enable better customer experience.

This investment has borne fruit: while sales were down overall, online-only fine art sales at the three leading auction houses jumped 240 percent according to a report by art market analysis firm ArtTactic. For the first eight months of 2020, online-only sales at Christie’s, Sotheby’s and Phillips totalled $321m, compared to $94.4m for the whole of 2019.

This consolidation of the online offer has been crucial for the survival of auction houses in this period but it also represents an opportunity going forwards. Sotheby’s reported to ArtTactic that over a third of online buyers were transacting with the auction house for the first time and that over a quarter were under the age of 40.

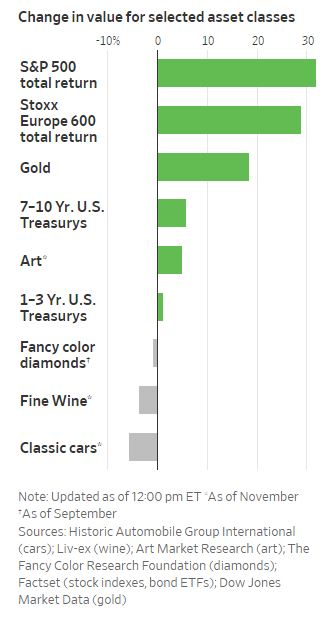

Stock Market Rally in 2020 Easily Outpaced Luxury Goods, Hedge Funds

January 4, 2021 / by Anna Hirtenstein

Collectibles: An integral part of wealth

October 2020 / Credit Suisse/ Research Institute

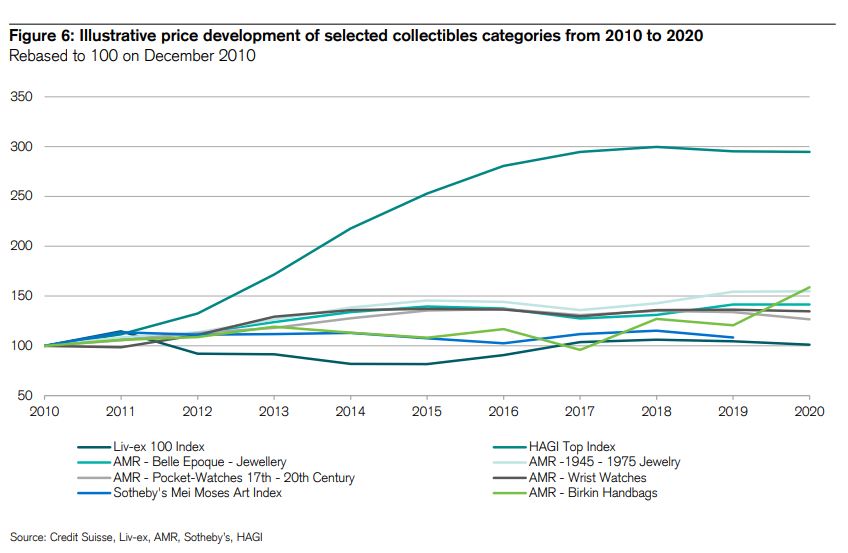

Credit Suisse Research Institute’s report on Collectibles as An Integral part of wealth compares performances of selected collectible categories (AMR has provided Jewellery and Watch indices) between 2010-2020 in the context of uncertainty created by the COVID-19. The Special focus section features findings of the AMR’s The Luxury Handbag Report 2020.

Sneaker Collections

October 28, 2020 / Lifestyle / by Maria Razumova

How have athletic sneakers became collector’s item

Director of Art Market Research, Sebastian Duty, comments on popularity of sneakers as a collectible – is not so much because of collaborations, but it’s down to influencer’s attention to them as an accessory. “A tweet or Instagram post from an influencer can quickly draw attention to a particular pair of sneakers, or emphasize that it was a limited edition. This strategy generates interest, and the sneaker becomes a collectible”. Last year, six pairs of shoes were sent to influential bloggers and celebrities to promote a limited edition Nike Air Max 97 called Jesus Shoes (with the tagline Walk on water). As a result, all 20 pairs of sneakers, worth over $3,000, were sold out within minutes.

The coronavirus pandemic has changed assumptions about auctions of watches and jewellery. Previously, many in the business had believed there was a price ceiling for online sales. But since auction houses have been forced to focus their efforts online, world-record prices have been fetched and houses have adapted their business plans as a result.

Timed online sales accounted for only 5 per cent of jewellery auctions at Bonhams before the pandemic. However, Jean Ghika, global head of jewellery, says they will be an “integral part” of the sales calendar in 2021.

It is this global drive to attract new, younger collectors that is behind the recent shift toward timed online auctions, says Sebastian Duthy, managing director of analyst Art Market Research, adding however that “the atmosphere of a [live] auction is exciting and no one wants to lose that entirely”.

Luxury Handbags Are Now Outperforming Art, Classic Cars and Whisky as Investment Items

June 26, 2020 / Robb Report / by Rachel Cormack

Turns out, a Birkin will bring you better returns than a Banksy

Anyone who’s bought a Birkin will tell you that it’s an investment. But, up until now, there’s been little hard data to back up that claim. Fortunately for bag lovers, a new report from Art Market Research (AMR) proves that the very thing designed to hold your money can actually make you more of it.

The burgeoning category of collectible luxury handbags outperformed art, classic cars and even rare whisky to claim number one position as an “investment of passion” this year.

“This is the fastest-growing collectors’ area and it’s the first time that women are running the category,” said AMR’s CEO Sebastian Duthy.

The research, which represents the world’s first group of indexes tracking collectible handbags, uses price information collated from the world’s leading auction houses to measure the performance of selected Hermès, Louis Vuitton and Chanel handbags. It showed, unsurprisingly, that the designer pieces skyrocketed well past their original retail price when listed for resale.

The Ultimate investment: Luxury handbags trump art and classic cars

June 26, 2020 / Tatler / by Hope Coke

Although often regarded as something of a guilty pleasure, fashion fans should rest assured that an ever-growing collection of handbags is not, in fact, a frivolous indulgence – but rather a wise financial investment.

According to the Times, a newly-published report by Art Market Research has revealed that luxury and vintage handbags now outperform art, classic cars and rare whisky in terms of their increase in value over time.

The iconic crocodile skin Himalaya Birkin by Hermès, for example, is often deemed the most collectible handbag in the world. The report found that covetable Birkin bags increased in price by 42 per cent on average last year – almost double that of the 23 per cent rise for Banksy artworks. In the years since 2010, the average values of the cult Hermès Kelly handbags, meanwhile, have risen 129 per cent. Art Market Research stated that Hermès handbags attracted ‘eye-watering’ prices last year, with their value increasing by as much as 300 per cent within only months.

Vintage fans bag an elegant investment

June 26, 2020 / The Times/ by Andrew Ellson

Luxury and vintage handbags are becoming the latest must-have investment after outperforming art, classic cars and rare whisky last year

Luxury and vintage handbags are becoming the latest must-have investment after outperforming art, classic cars and rare whisky last year.

In a report published yesterday, Art Market Research said that “eye-watering” prices were secured for rare Hermès handbags in 2019, with one increasing 300 per cent in value in months.

Birking handbags increased in price by 42 per cent on average last year compared with a 23 per cent rise for artworks by Banksy.

Sebastian Duthy, chief executive of Art Market Research, said: “Some new bags sourced in store are being sold at auction for up to two and a half times retail price.” In 2019, 3,700 designer handbags sold for £26.4 million at auctions around the world.

The Knight Frank Luxury Investment Index – Art update

May 21, 2020 / The Wealth Report / by Andrew Shirley

Sebastian Duthy and Veronika Lukasova of Art Market Research, which provides the data we use to track the performance of art – one of the 11 asset classes covered in our Luxury Investment Index – provide an update to the current market

How was the market for art performing prior to the Covid-19 outbreak?

Brexit uncertainty compounded by China-US trade tensions undermined confidence in the art market in 2019. However, this was offset to a degree by growing online sales which are more inclusive of younger generations keen to collect.

Our Global Index of artists, which tracks the value of their works sold at auction worldwide, has risen by 134% over the decade, but grew just 4% during the past 12 month. In the first quarter of 2020 it was up 1%.

How has the outbreak affected the market?

The outbreak of the coronavirus had an immediate impact on the number of public sales and auction houses were quick to offer online viewing services and private sales.

An uncertain future has split views among collectors, however, and while those who buy for passion are holding fire, the less risk-averse are seeing an opportunity.

Leading gallerist David Zwirner even suggested that 2020 might be one of the great years for collecting.

At Sotheby’s carefully curated Contemporary Day Auction in May, 96% of the lots on offer were sold. Sotheby’s records the number of bids for timed auctions and the most keenly sought after were for works by artists born in the 1980’s – Claire Tabouret, Loie Hollowell, Jullie Curtiss and Lucas Arruda.

Christie’s online sale Contemporary Art Asia (closing April 30), showcasing prints and multiples by in-demand artists, was 100% sold with two thirds selling above estimate.

How do you think the market will change once the world has recovered from Covid-19 and which are the artists and genres to watch

Collectors are increasingly expecting a return at some point down the line and with many more buying online, auction houses will have to create exciting new formats to stay relevant.

Christie’s announced a new kind of sale called ONE in July which is a global 20th-century art auction spanning four cities in one relay-style format.

Sales of women artists continues to pick up slowly and if recessions hit hard around the world, we can expect to more consignments from private collections.

In May, one of just a few works by the female Old Master, Orsola Maddalena Caccia, made a surprise appearance at Sotheby’s. Still Life of Birds is a study of a chiffchaff, blue tits and a goldcrest and came from an Italian Private Collection.

The work was knocked down at £212,500 (with fees) after 49 bids against an estimate of £10,000-15,000.

Great Depression of the 21st century looms over the art market

April 28, 2020 / The Art Newspaper / by Anny Shaw

WORSE THAN 2008 CRASH? As the IMF warns we are heading towards the worst economic slump in living memory, the art industry starts to fear a double dip recession.

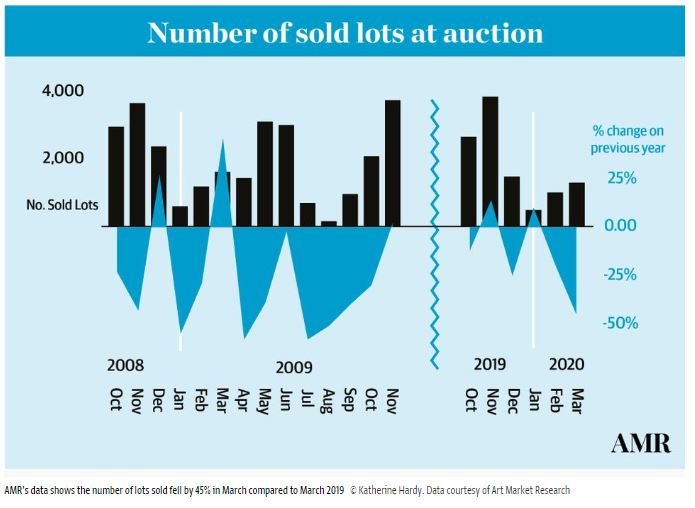

Early figures suggest the art market could be on course for a similar crash to 2008/09, if not worse. According to data compiled by Art Market Research (AMR), in March 2020 (see graph below) there was a 45% drop in the number of fine art lots sold at auction compared with the same month in 2019—not altogether unsurprising given the unprecedented closure of auction houses. More than half of March’s 80 fine art sales have been postponed.

That drop almost exactly mirrors the 43% dive in sales recorded in November 2008, the first real public test of the market after Lehman Brothers filed for bankruptcy two months earlier. The biggest plunge—59%—came in July 2009.

Supply may be down but (some) demand is still there. “Collectors haven’t deserted the market in huge numbers yet,” says AMR’s managing director Sebastian Duthy. “Of course, it took several months before the impact of the 2008 crisis was fully realised in terms of drop in sales, so we shall have to wait and see how consigners respond to this crisis.” He notes that some smaller auctions have done well online, including Sotheby’s 20th-century design sale in March, which brought in $4m—more than 25% above its high estimate. Now that we are cooped up at home, interior decoration has perhaps never felt so vital.

Forget wine, watches and whisky: this is the new safe haven of millionaires

March 5, 2020 / The Telegraph / by Marianna Hunt

The value of handbags has risen more than whisky and art combined over the past year

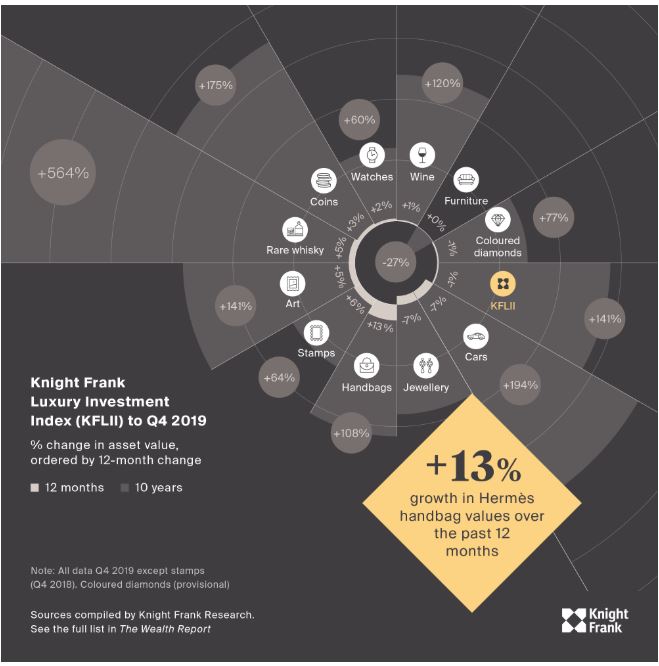

While price increases have slowed in the worlds of luxury watches, wines and whiskies, another asset class has been motoring ahead.

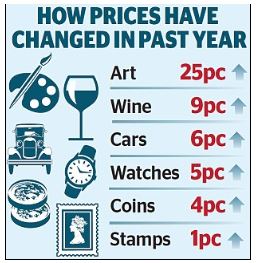

Every year estate agency Knight Frank compiles an index comparing the performance of different luxury investments. This year a newcomer entered the top spot, with a price increase of 13pc over 2019.

.

Why a Hermès handbag can be a better investment than art

March 5, 2020 / Quartz / by Marc Bain

If you were looking for a nice short-term investment in 2019, you may have been better off putting your money into one of Hermès’s rare handbags than the work of a long-expired painter, according to an analysis by global real-estate consultancy Knight Frank.

The firm found Hermès handbags increased the most in value in its 12-month index of what you might call alternative investment assets, including art, stamps, rare whiskey, watches, coins, cars, and more. (Traditional financials assets such as stocks and bonds weren’t included). Over 12 months, its bag index grew 13%, well above the runners up of stamps (6%) and art (5%). Knight Frank published the numbers in its annual wealth report on investment and luxury, using data provided by Art Market Research, which has an established methodology for analyzing the value of the art, antiques, and collectibles markets.

Designer handbags become the new must-have investment – outperforming whisky, art and classic cars

March 3, 2020 / This is Money/ Daily Mail / by Holly Thomas

Designer handbags are the most profitable luxury investment, according to a new report from Knight Frank.

The Wealth Report today reveals that the collectable accessories have knocked rare whisky off the number one position, looking at one year returns.

The value of designer handbags has risen by 13 per cent over 12 months, it says.

Sebastian Duthy, director of Art Market Research, says: ‘It’s only been possible to create an index on handbags now because of the frequency with which many iconic pieces are coming to auction today.

While bags made by luxury brands such as Chanel and Louis Vuitton are also highly collectable, it is those made by Hermès that attract the highest prices and are considered the most desirable.

The Luxury Investment Index 2020: discover the world’s most-coveted items

March 4, 2020 / Knight Frank / The Wealth Report

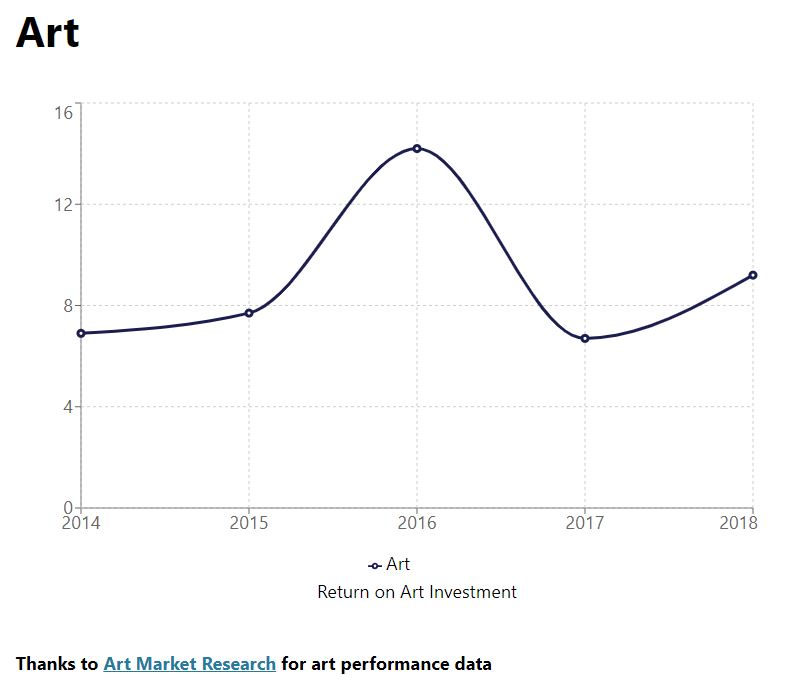

Art

Veronika Lukasova-Duthy, Art Market Research

2019 was the fourth consecutive year that overall individual artist records fell, while record sums were paid for works by living artists – such as Jeff Koons’ stainless steel Rabbit, which sold for US$91 million in May. With a rise of around 5% this year, the art market continues to adapt to a slowing supply of works by Impressionists and Modern masters. Other winners in contemporary sales were urban artists Invader, who broke the US$1 million mark at auction for the first time with the tile mosaic TK_119, and Banksy, whose painting Devolved Parliament sold for around five times the artist’s previous record in 2008.

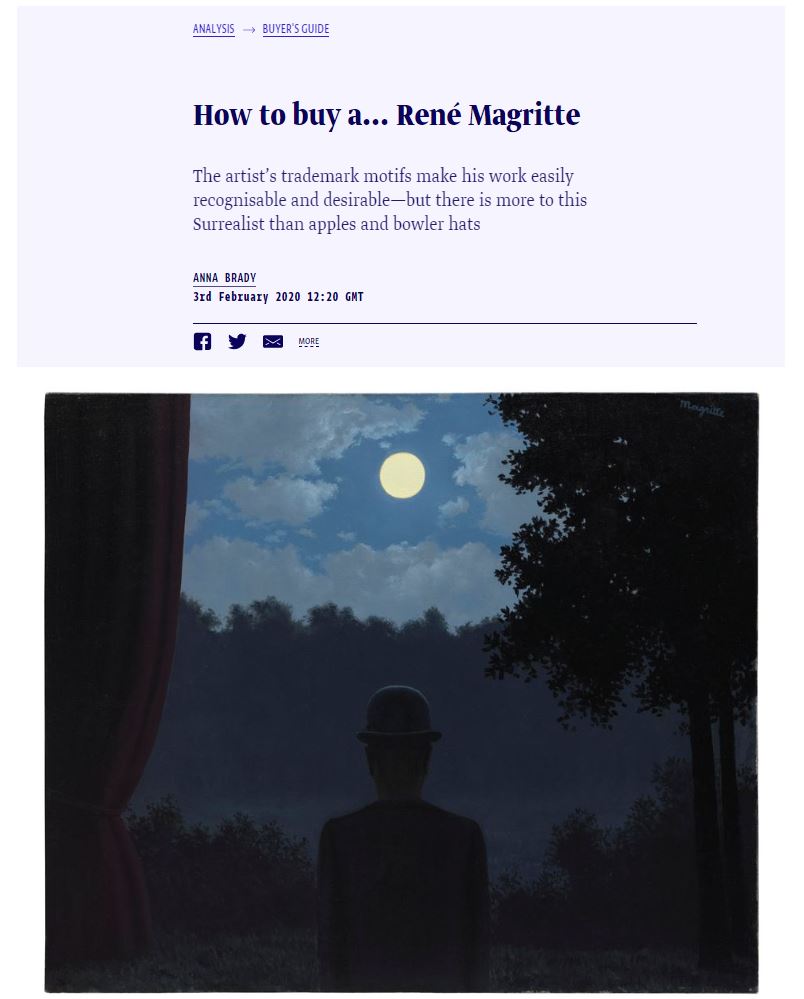

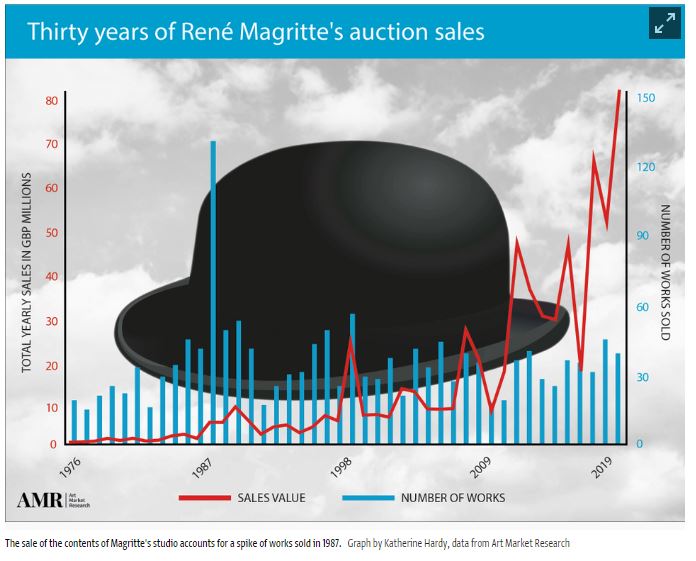

How to buy a… René Magritte

February 3, 2020 / The Art Newspaper / by Anna Brady

The artist’s trademark motifs make his work easily recognisable and desirable—but there is more to this Surrealist than apples and bowler hats

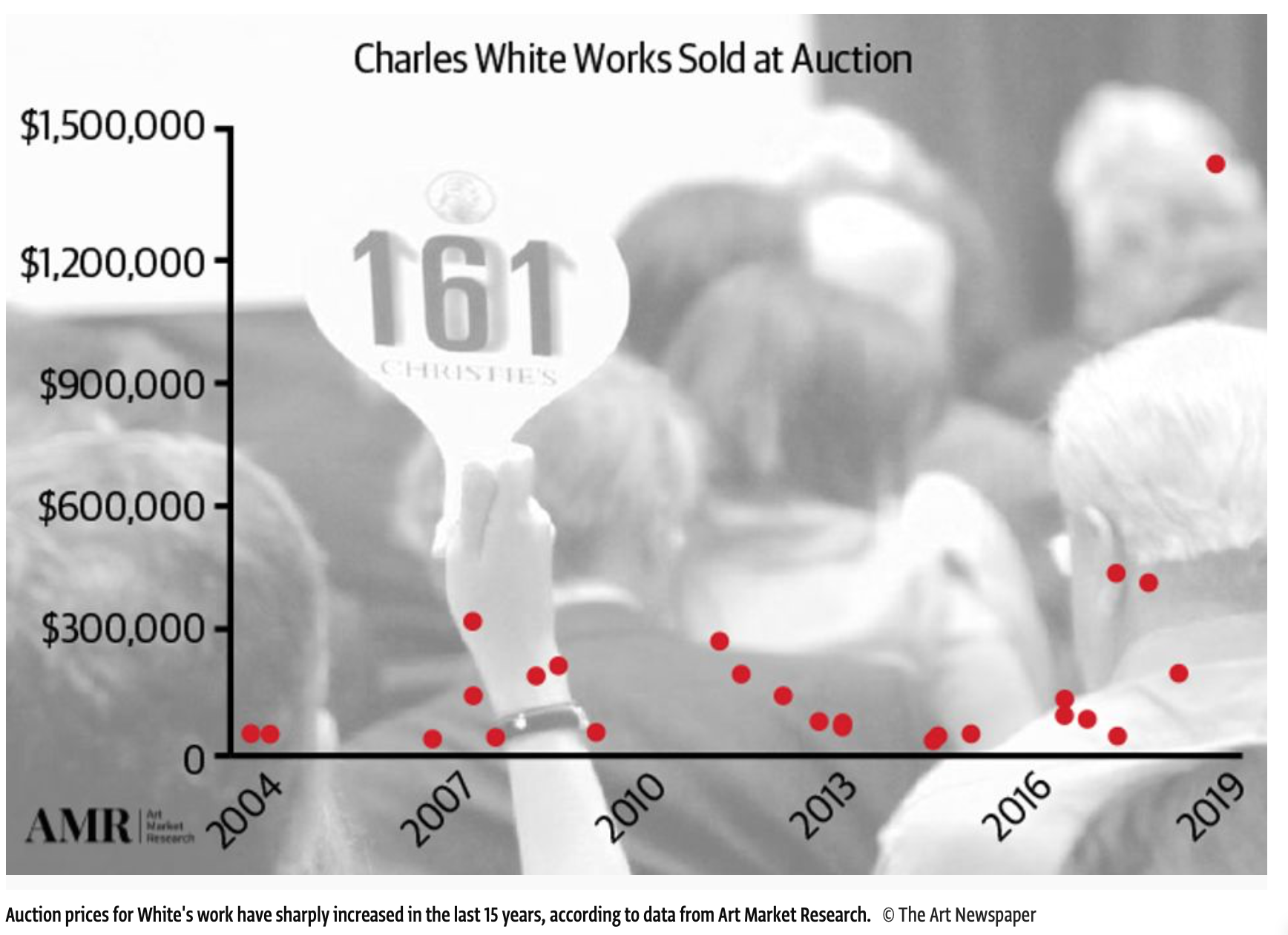

Buyer’s Guide to…Charles White

Charles White chronicled the African American experience when white male abstraction ruled. Now record prices for his work are frequently reset.

The Finer Things in Life Weren’t Good Investments in 2019

The number of blockbuster sales dipped markedly. Out of the 40 most expensive paintings ever bought at auction, 18 were sold in 2018 compared with just three in 2019, Art Market Research estimates.

“There were worries about the trade war with China that certainly looks to be having an impact. And London has been one of the three major centers of the art market, so the continuing Brexit uncertainty continues to drag the market,” Sebastian Duthy, director at Art Market Research.

Among the best-known sales of 2019 was Banksy’s Devolved Parliament, which depicts primates sitting in place of lawmakers in the U.K. legislature and sold for £9.8 million ($12.8 million) at Sotheby’s, a record sum for the artist.

The falling value of wine, art and high-end diamonds in 2019 contrasts with a rally in luxury stocks. Shares in Kering SA, the parent company of Gucci, have gained over 40% this year, while LVMH Moët Hennessy Louis Vuitton SE, whose brands are considered most resilient in an economic downturn, is up 60%.

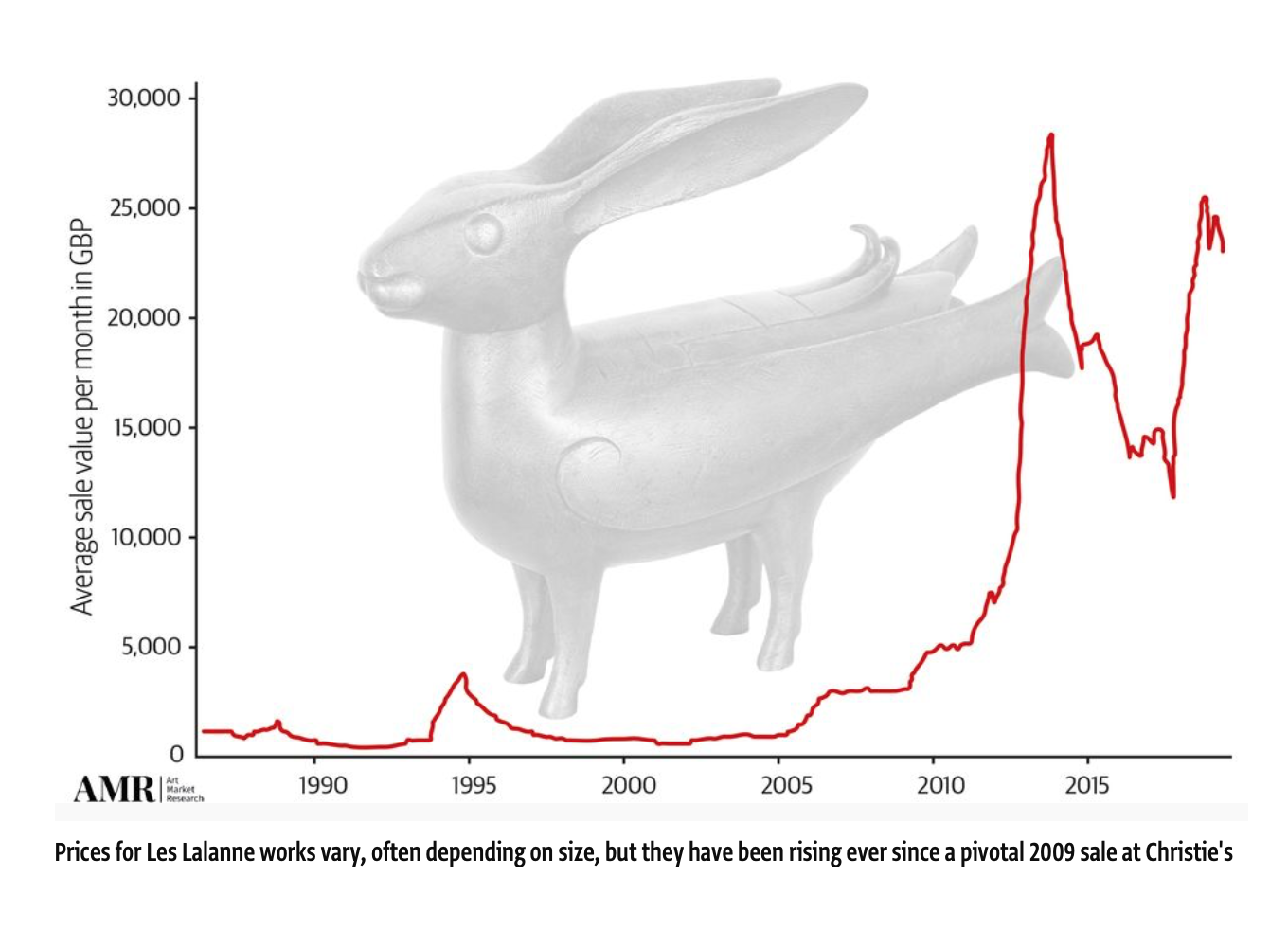

Buyer’s Guide to…Les Lalanne

Consumers from China to Japan recognise their own cultures’ influence on this era’s aesthetic. Kate Youde reports on rising popularity of high-quality art deco jewelery pieces in Asia.

In the first quarter of this year, prices for Belle Époque (the 40-year period before the outbreak of first world war) and art deco jewellery grew 9 per cent compared with the same period in 2018, auction sales data from Art Market Research shows, and 104 per cent over the decade.

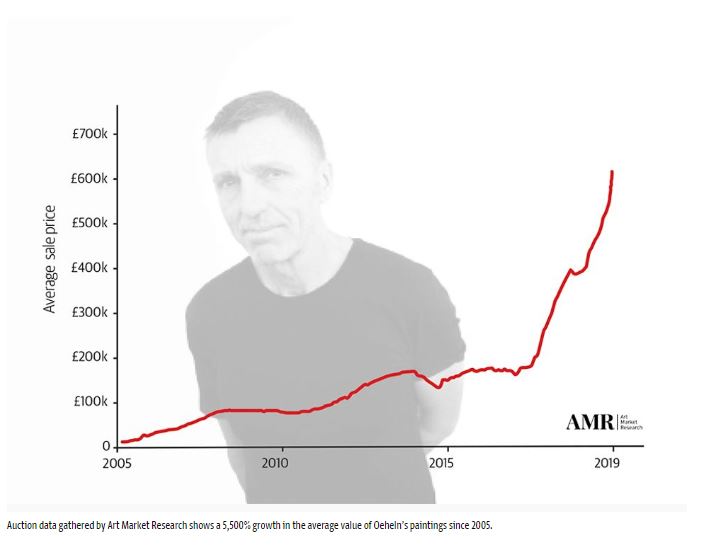

Buyer’s Guide to…Albert Oehlen

Appeared in Frieze London dailies / Issue 1, 2019

Buyer’s Guide to…Louise Bourgeois

Over the course of her eight-decade career (she was almost 100 when she died in 2010), Bourgeois’s visceral work covered the gamut of human experience—from sexuality to mortality—and engaged with many Modern art movements. From the totemic Personages sculptures of the 1940s and 50s to her fabric creations, cage installations, prints and drawings, and those famous bronze spiders, Bourgeois’s work has global appeal, fostered by institutional shows from her hometown of New York to, more recently, Shanghai and Beijing.

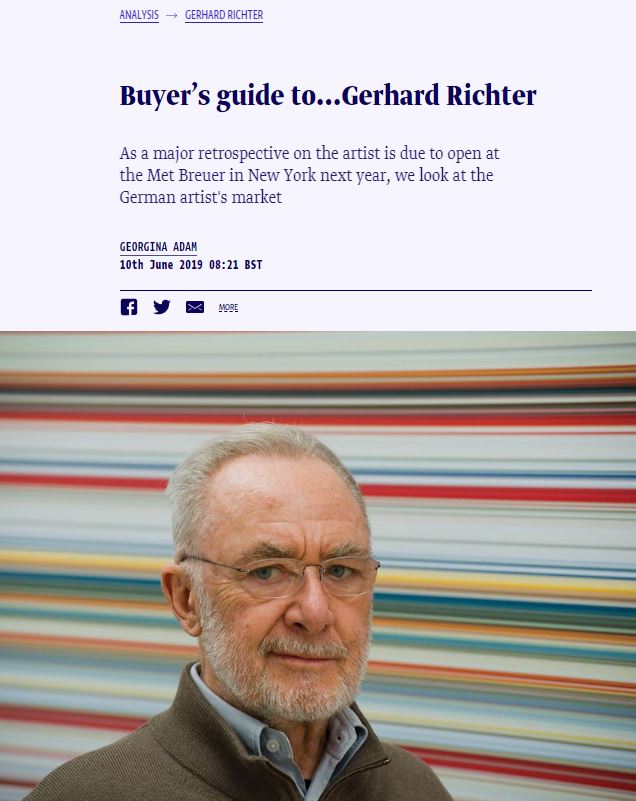

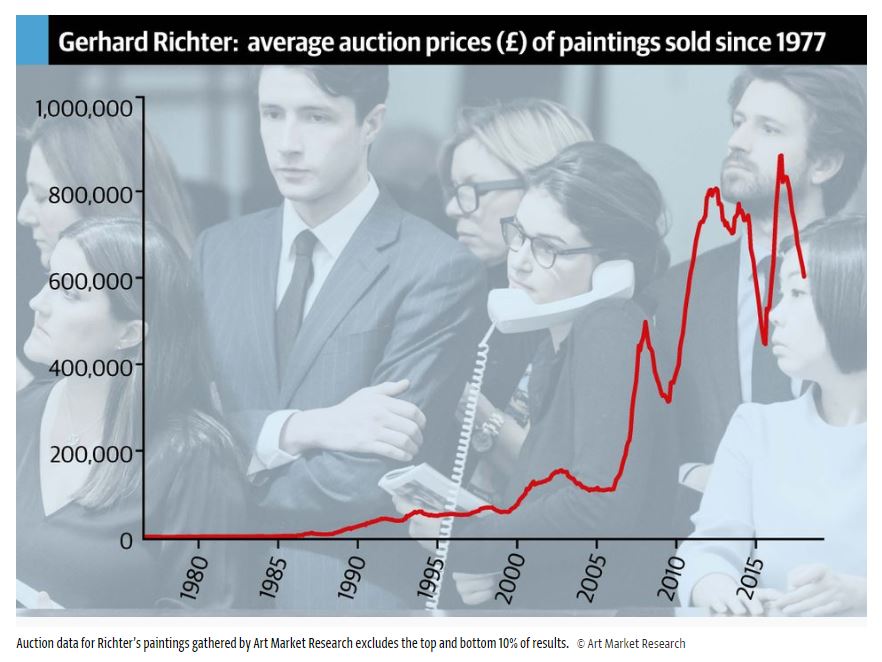

Buyer’s Guide to…Gerhard Richter

Leslie Rankow, an established art consultant, Sebastian Duthy, Director of AMR and Robin Kalota of Plan Art LLC share their views on the issue.

The Clarion List is a leading online resource for art service companies worldwide.

Dellasposa is a fine art gallery and art advisory service based in London.

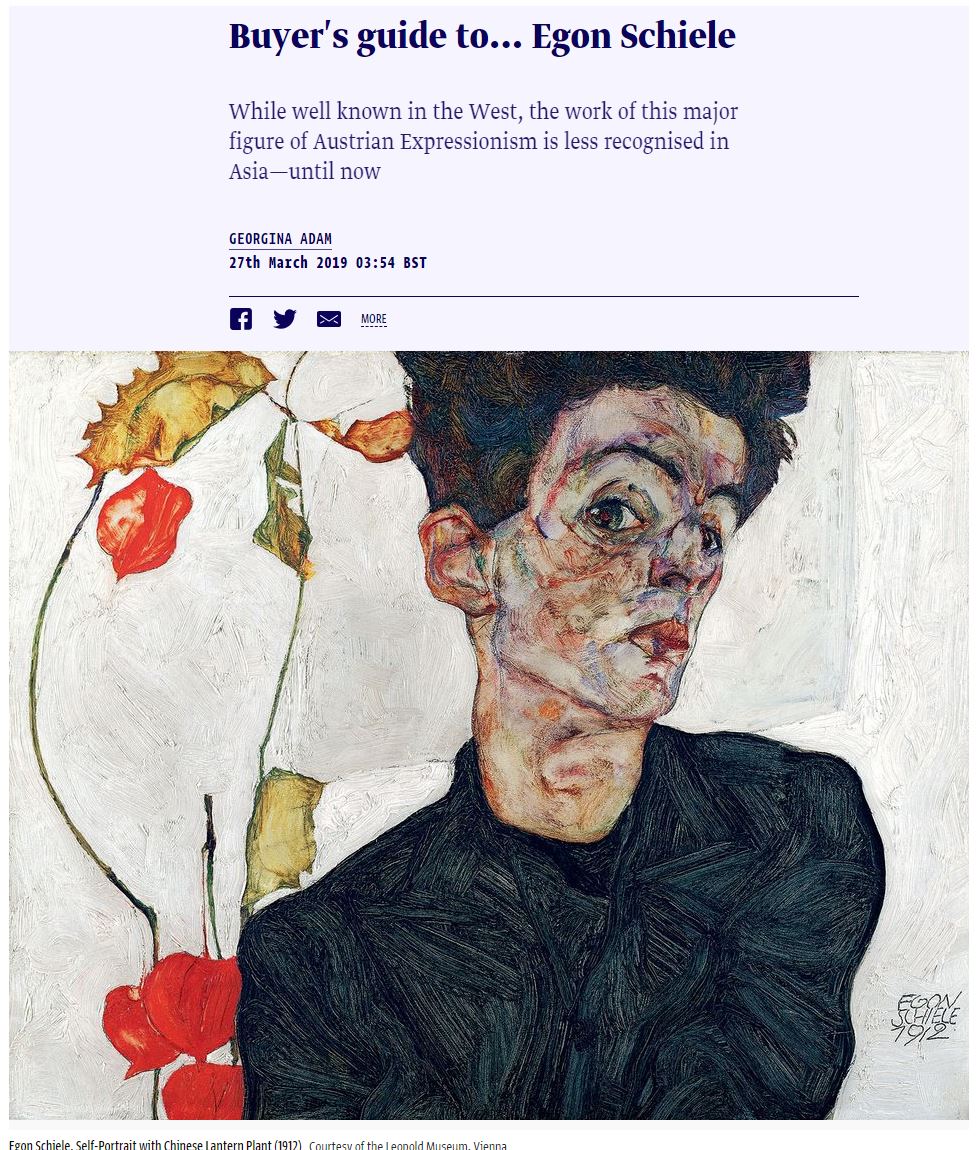

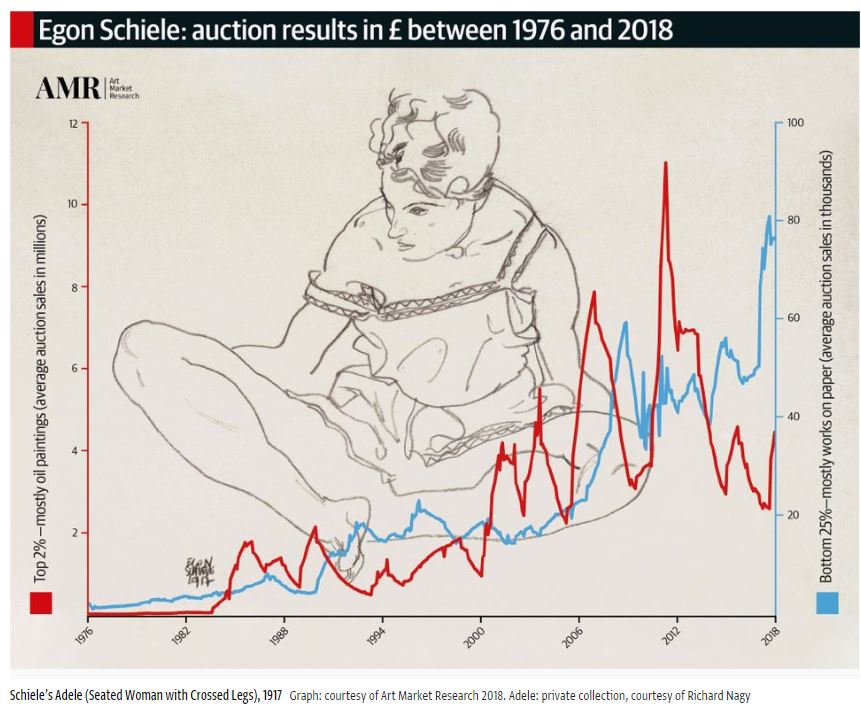

Buyer’s Guide to…Egon Schiele

Buyer's Guide to....Egon Schiele

‘While well known in the West, the work of this major figure of Austrian Expressionism is less recognised in Asia—until now’.

Georgina Adam analyses Schiele’s auction prices as London dealer Richard Nagy brings 40 artworks by Egon Schiele to this year’s Art Basel Hong Kong.

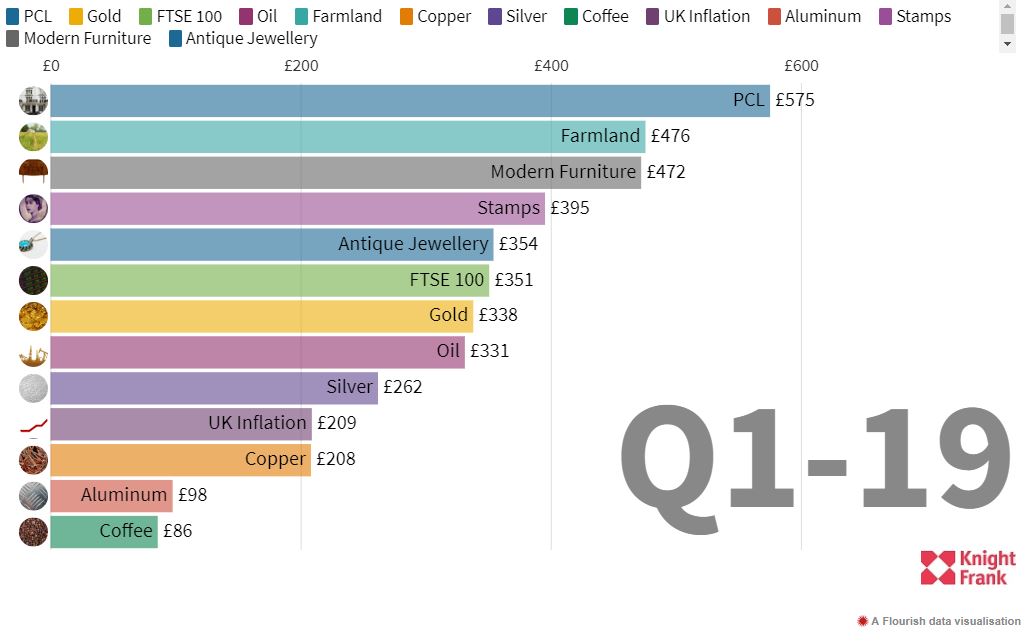

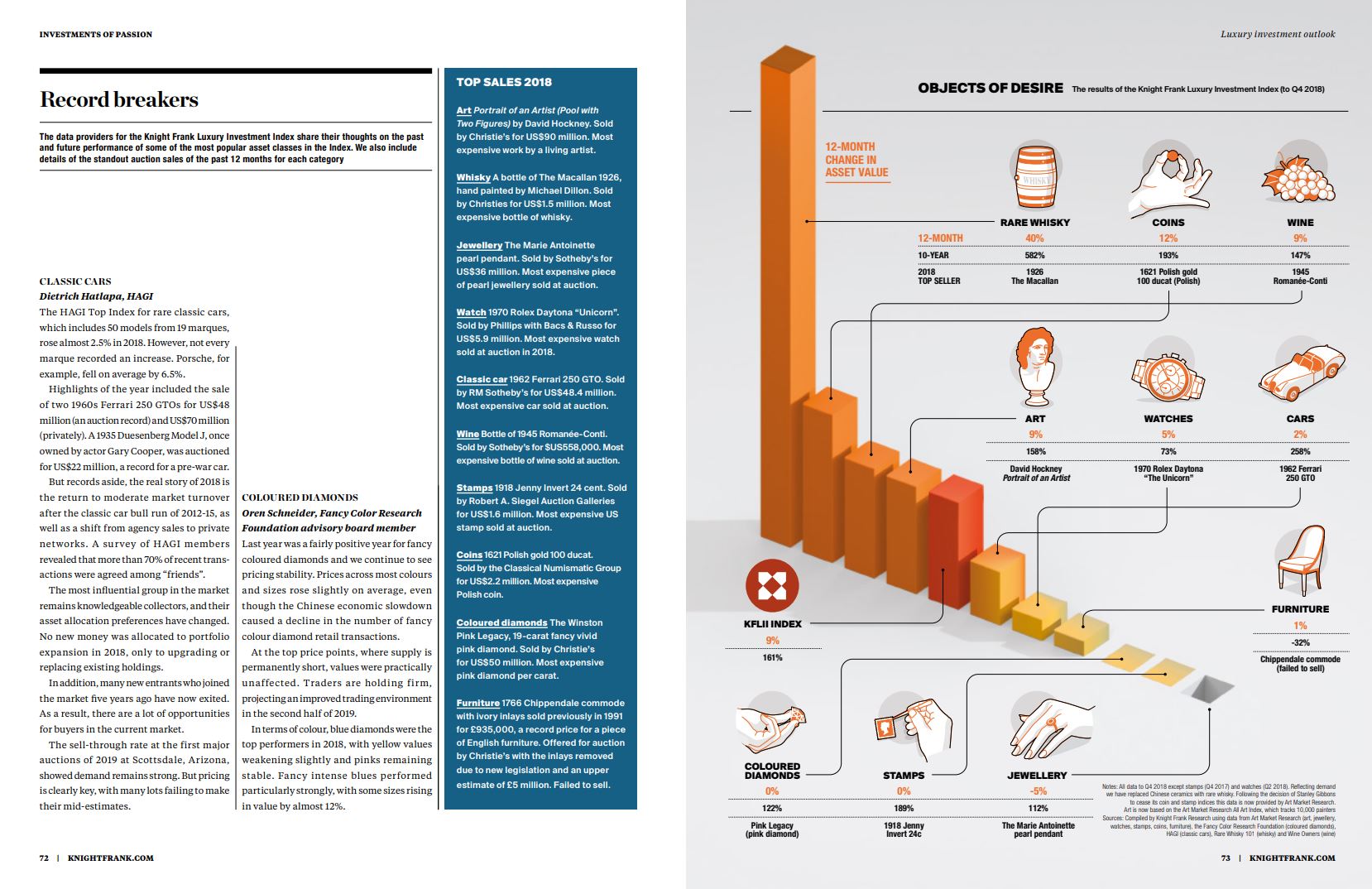

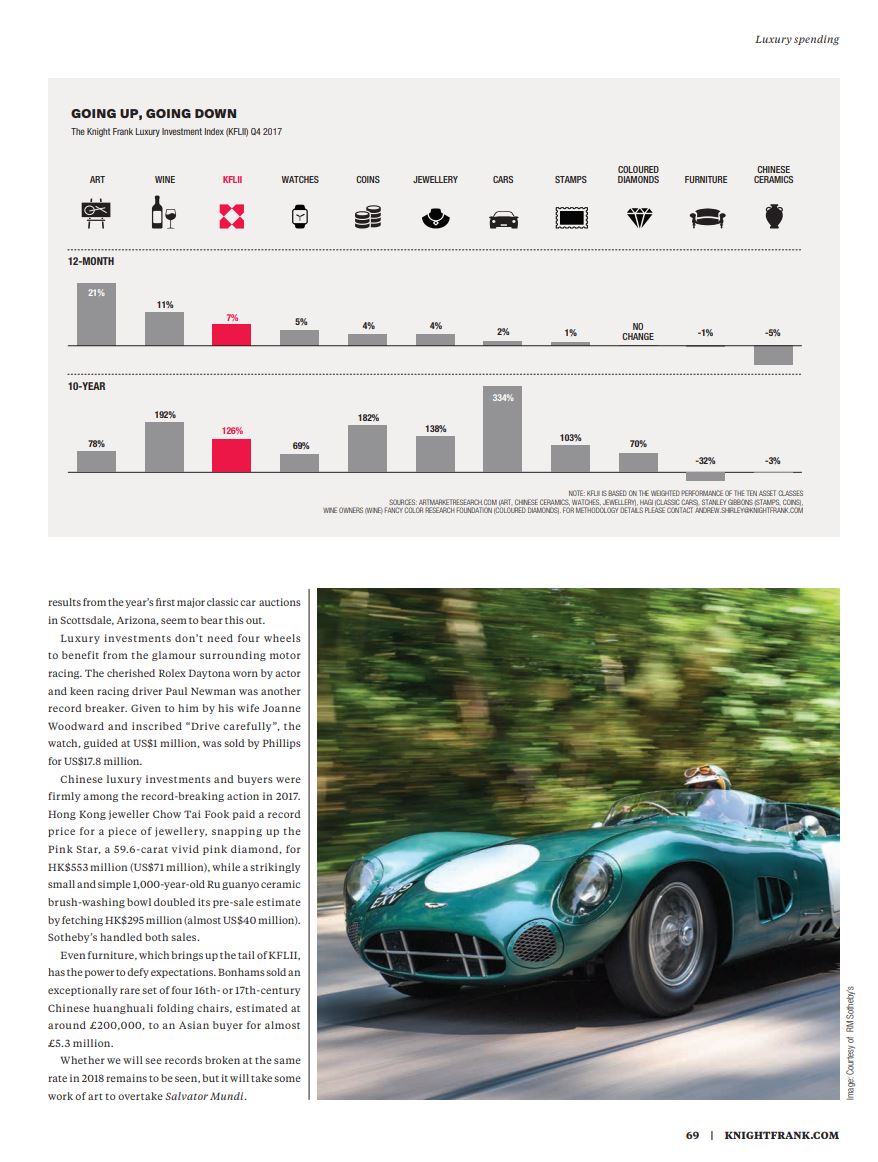

Knight Frank Luxury Investment Index 2019

Knight Frank Wealth Report has been launched today across the globe. The Knight Frank Luxury Investment Index 2019, go-to report for measuring passion investments with several categories underpinned by AMR indices.

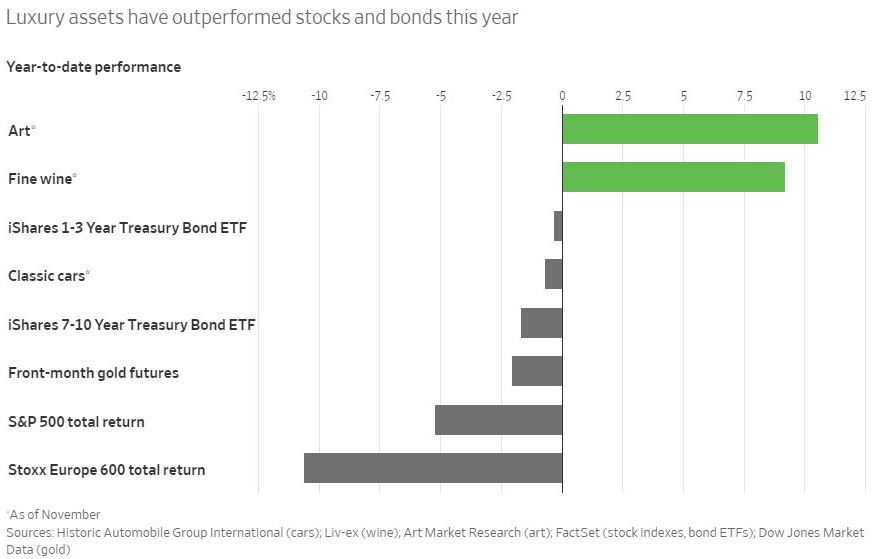

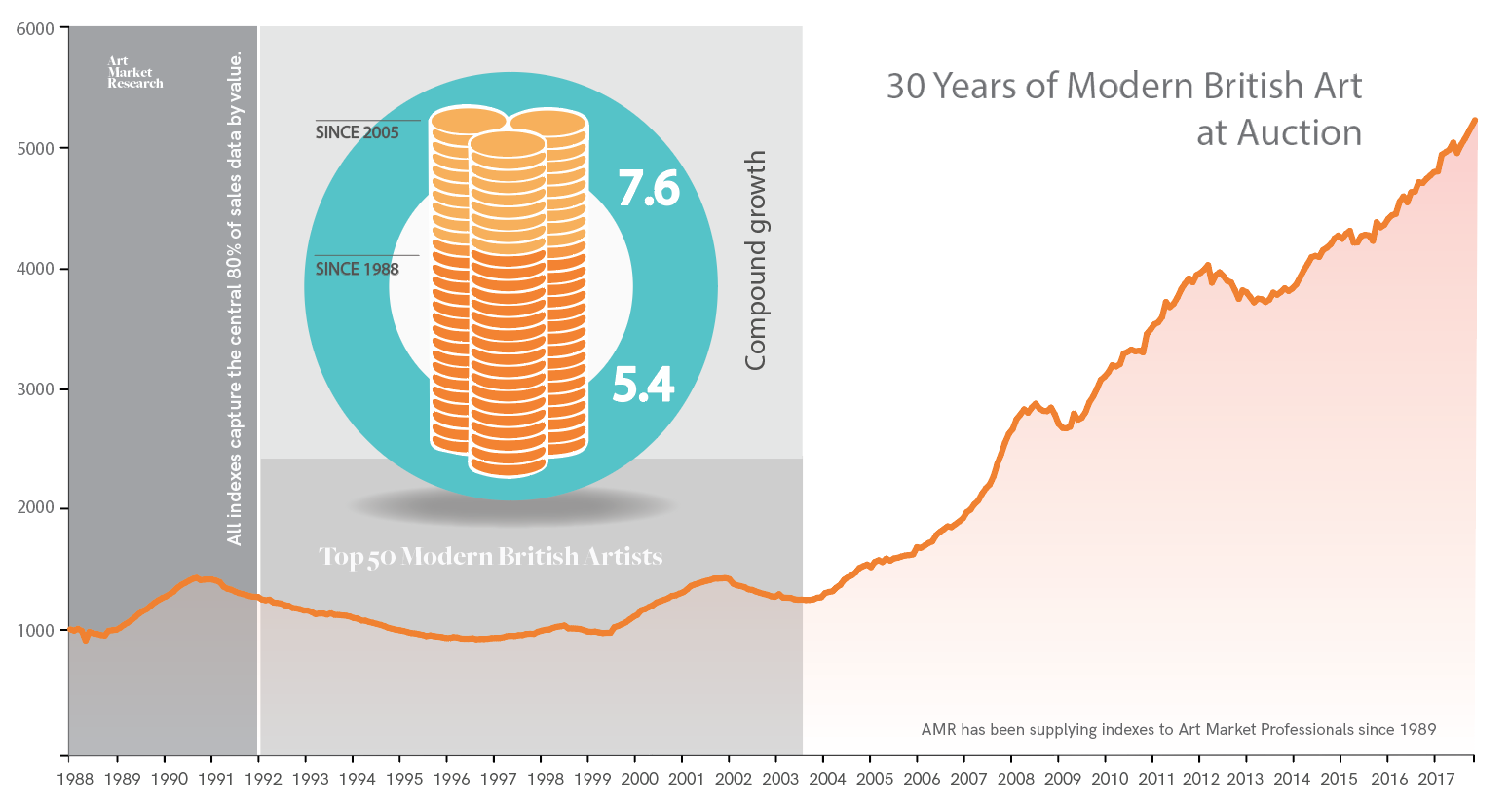

The Best Investment of 2018? Art, Wine and Cars

‘Unattributed works that are connected with stellar name artists can regularly achieve higher prices than some firmly attributed works by lesser artists.’ says Veronika Lukasova of Art Market Research.

Alternative Investments

Frankfurter Algemeine Zeitung reports on Knight Frank’s Luxury Investment Index 2018.

‘Prices for works by Impressionists and Post-war artists have dominated auction sales for the last two decades. But this picture has been changing, with works by some contemporary artists appreciating rapidly in the last few years. In March, artist Mark Bradford hit the headlines when his painting ‘Helter Skelter I’ was sold by ex-tennis star John McEnroe for a record $10.4m at Phillips in London. In May, rapper Sean Combs, aka P Diddy, paid $21.1 million at Sotheby’s for a painting by artist Kerry James Marshall. The figure represents an 800-fold increase on the $25,000 paid for the same work in 1997.’ says Sebastian Duthy.

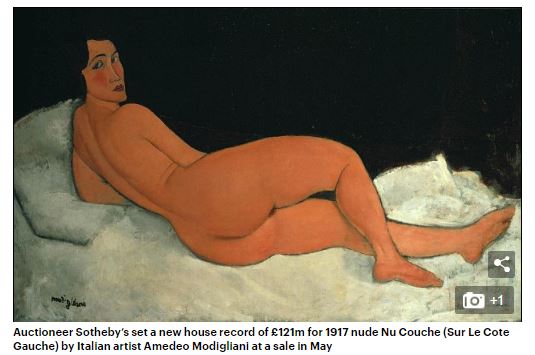

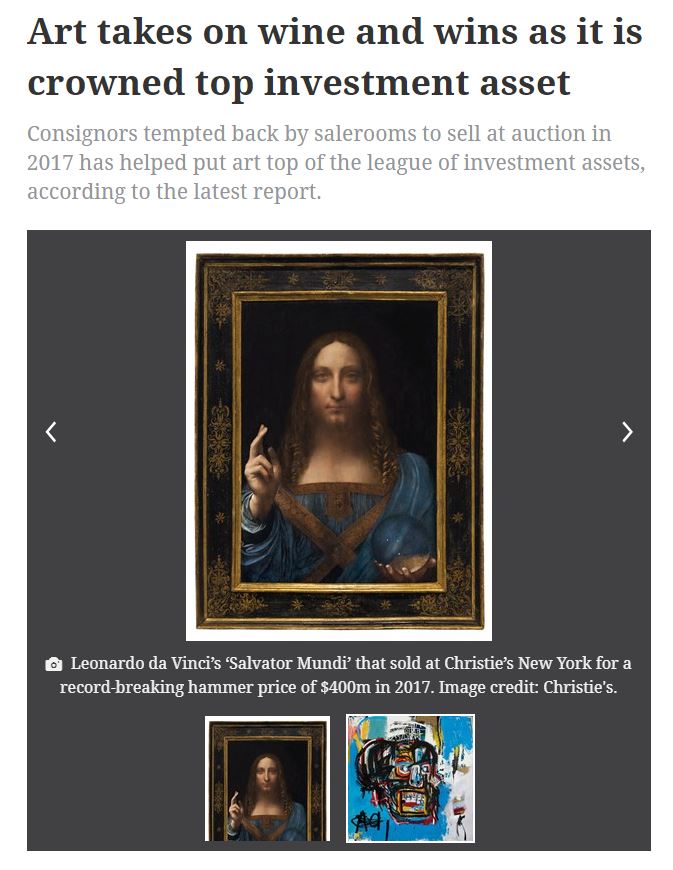

Knight Frank Luxury Investment Index 2017

“As prices for the very best 19th and 20th century art continue to hit the headlines, there is hope within the industry that the sensational Da Vinci sale could attract a wider audience to Old Masters in 2018.” says AMR director, Sebastian Duthy.

“Volatility in the art market has been driven by prices of post-war and contemporary art in the last few years. After a depressed market in 2016 caused widespread concern, consignors were tempted back by auctioneers last year.”

Knight Frank Luxury Investment Index 2017

TOP TEN: Bonhams unveils the jewels commanding high prices at auction

January 15, 2018 / by Stacey Hailes

Global auction house Bonhams has revealed the jewels set to perform particularly well at auction this year. As part of its ‘January Jewels’ campaign, which hopes to help Britons understand the true value of family heirlooms that might be gathering dust, Bonhams has unveiled a top 10 list of ‘hot jewels’ that are especially in demand.

6/ Belle Epoque/Art Deco Jewellery

Jewels from particular eras are also catching the eyes of buyers around the world. New data by Art Market Research shows strong performance of jewellery over the last decade. In the last decade, antique jewellery is up by 54 per cent; jewellery from the 1945-1975 period is up by 88.9 per cent and Art Deco (1920s and 1930s) and Belle Epoque jewellery (1890 to 1915) up by 71.8 per cent.

Pre-sale guarantees set to create new high for Sotheby’s Impressionist and Modern art sales

According to the late Robin Duthy’s Art Market Research Index, now managed by his son, Sebastian, the surrealist market witnessed a boom between 2006 and 2013 when prices were increasing by an average 20 per cent a year. Christie’s annual surrealist sales in that period jumped from £10 million to £37 million, and in 2015 leapt to £66.6 million. At that sale it was noticeable how many Asian bidders were coming into the market.

Art Vs Stock

According to Art Market Research Developments, the underlying value of American pop art has increased nine times faster than the S&P 500 index in the past ten years. Some of the biggest gains have come in niche categories, like 19th-century American photography or 20th-century Belgian painting. The latter group has been dominated by René Magritte: 22 of his paintings have sold for more than $5m over the period. Before borrowing heavily to speculate on a Renaissance masterpiece, you should know that Italian Old Masters have lagged the S&P since 2006. Still, even if they haven’t been a great investment, if you love them, now may be a good time to buy.

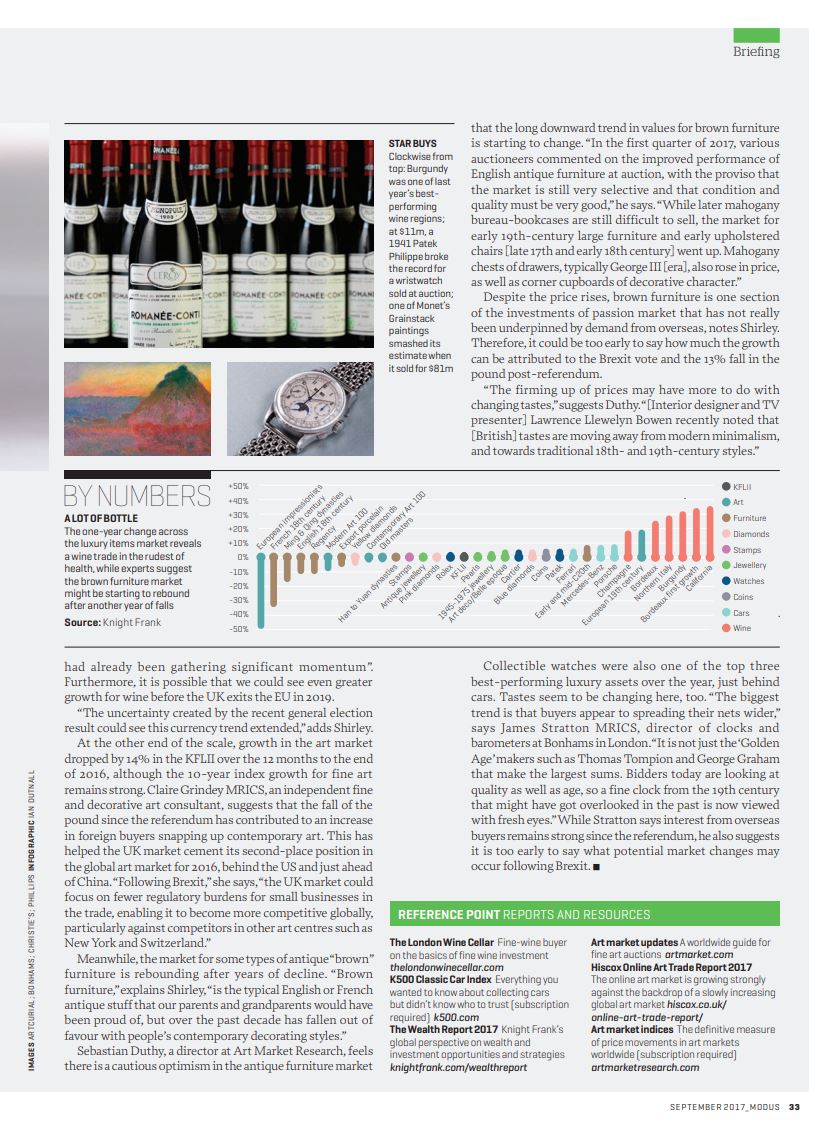

Collector’s Items

“Investments of passion”, such as art, antiques, classic cars, collectable coins or fine wine, do not perhaps receive quite the same level of attention as the buying and selling of buildings or land. Nevertheless, their demand as alternative investments continues to flourish, as demonstrated by the £8bn generated annually in the UK by the arts and antiques market alone.

Sebastian Duthy, a director at Art Market Research, feels there is a cautious optimism in the antique furniture market that the long downward trend in values for brown furniture is starting to change.

Copyright © 2023 Art Market Research, All Rights Reserved