Market Insights: Comparing categories

Sales of art, antiques and collectibles on the secondary or auction market provide the best picture of fair market value at any time. We’ve been collecting data on auction transactions for over 40 years and regularly compile the data to see how these fair market values have changed since. The data is used by many well-known organisations looking for high quality research analysing key categories driving the high-end secondary market. Below, we present the latest sample of our findings for nine of these key categories, showing one and 10 year change for each. With the COVID-19 pandemic threatening so many business and livelihoods at the start of 2020, many of the top auction houses found themselves well placed to adapt. Having already bet on a new generation of collectors for several years, and with online transactions of over £1m now common, auction houses were able to circumvent many of the lockdown restrictions. This didn’t mean industry escaped entirely unscathed as some markets slowed, particularly at the very top end. For a quick overview of the market performance in 2020, toggle the commentary section.

Market Insights: Comparing categories

Sales of art, antiques and collectibles on the secondary or auction market provide the best picture of fair market value at any time. We’ve been collecting data on auction transactions for over 40 years and regularly compile the data to see how these fair market values have changed since. The data is used by many well-known organisations looking for high quality research analysing key categories driving the high-end secondary market.

Below, we present the latest sample of our findings for nine of these key categories, showing one and 10 year change for each. With the COVID-19 pandemic threatening so many business and livelihoods at the start of 2020, many of the top auction houses found themselves well placed to adapt. Having already bet on a new generation of collectors for several years, and with online transactions of over £1m now common, auction houses were able to circumvent many of the lockdown restrictions. This didn’t mean industry escaped entirely unscathed as some markets slowed, particularly at the very top end. For a quick overview of the market performance in 2020, toggle the commentary section.

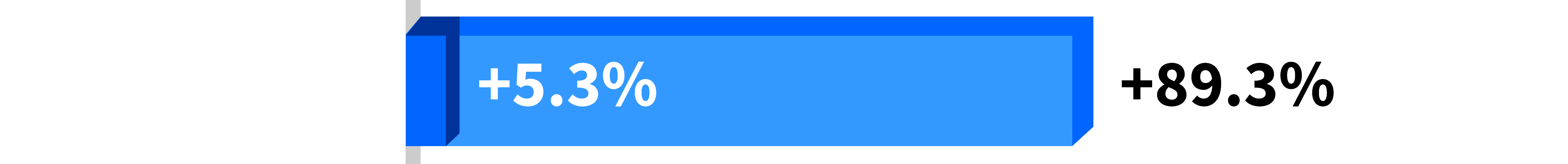

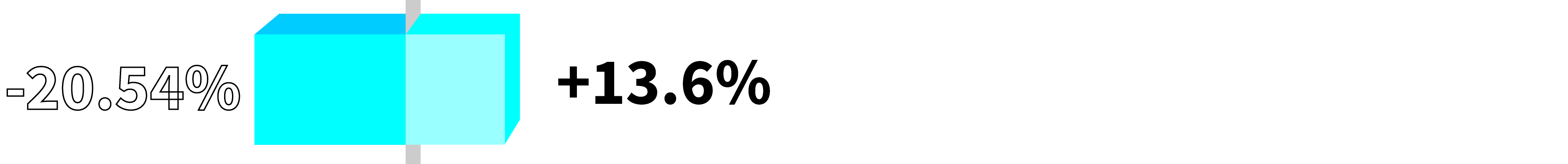

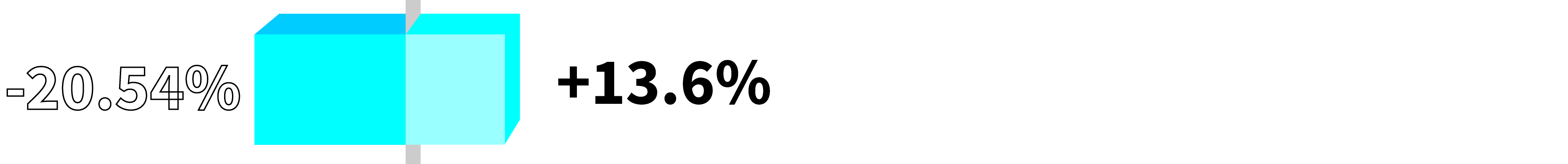

ALL ART

Figures are based on AMR’s All Art Index

2020 Art Market Overview

With so many factors impacting the market for art in 2020, there’s no one single reason for the fall in average values. The total volume of sales was down -29% across major auction houses worldwide when compared with 2019, suggesting that shift to private sales during lockdown had been profound. Indeed, much of the change in spite of efforts to keep business running smoothly. Although most sales were postponed in the first days and weeks of the lockdown, auction houses houses squeezed many more sales into the second half of 2020. With collectors quick to take advantage of online viewing rooms, the number of sold lots was down just -16% by the end of year . However, the number of Individual Auction Records surpassing £100,000 declined dramatically (-38% by December) as many consigners of top-quality works decided to wait for more favourable conditions and ultimately average values were down -11% by the end of the year.

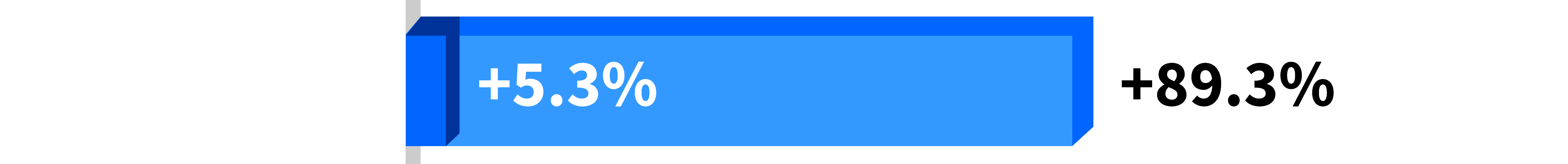

ALL ART

Figures are based on AMR’s All Art Index

2020 Art Market Overview

With so many factors impacting the market for art in 2020, there’s no one single reason for the fall in average values. The total volume of sales was down -29% across major auction houses worldwide when compared with 2019, suggesting that shift to private sales during lockdown had been profound. Indeed, much of the change in spite of efforts to keep business running smoothly. Although most sales were postponed in the first days and weeks of the lockdown, auction houses houses squeezed many more sales into the second half of 2020. With collectors quick to take advantage of online viewing rooms, the number of sold lots was down just -16% by the end of year . However, the number of Individual Auction Records surpassing £100,000 declined dramatically (-38% by December) as many consigners of top-quality works decided to wait for more favourable conditions and ultimately average values were down -11% by the end of the year.

Watches

Figures are based on All Sectors of AMR’s Wrist Watch Indexes, including Patek Phillipe, Rolex, Cartier and others.

2020 Watches Overview

The watch market showed remarkable resilience throughout 2020 despite the impact of the Coronavirus pandemic. Major watch auction houses such as Sotheby’s, Christie’s and Antiquorum were forced to focus on their internet auctions; reticence from some buyers to use this medium for purchasing prior to the pandemic largely evaporated. Notably many watch auctions and collections were held as online-only sales.

Condition and rarity continued to be the most important factors determining results of individual pieces. Sports watches including Daytona chronographs continued to lead the market for Rolex wristwatches with some exceptional prices paid for the finest examples. Results of Patek Philippe watches remained extremely strong for rare complication pieces and the trend and popularity of the brand’s Nautilus models, which have seen remarkable growth in the last few years, appeared to continue. There was some filtering down to the lower parts of the market which saw growth among entry-level watches in the £1,000-£5,000 range across the most collected brands and models although condition was again critical.

Within the pocket watch market, demand was strong where estimates were pitched conservatively. However, as with wristwatches, condition and rarity were key to the best results. Demand was most in evidence for highly decorative watches, especially those originally produced for the Chinese and Turkish markets. Fine watches with automata, exceptional Breguet watches and well-preserved early watches from the 17th century were keenly sought after at auction, with some exceptional prices achieved for the rarest pieces.

Watches

Figures are based on All Sectors of AMR’s Wrist Watch Indexes, including Patek Phillipe, Rolex, Cartier and others.

2020 Watches Overview

The watch market showed remarkable resilience throughout 2020 despite the impact of the Coronavirus pandemic. Major watch auction houses such as Sotheby’s, Christie’s and Antiquorum were forced to focus on their internet auctions; reticence from some buyers to use this medium for purchasing prior to the pandemic largely evaporated. Notably many watch auctions and collections were held as online-only sales.

Condition and rarity continued to be the most important factors determining results of individual pieces. Sports watches including Daytona chronographs continued to lead the market for Rolex wristwatches with some exceptional prices paid for the finest examples. Results of Patek Philippe watches remained extremely strong for rare complication pieces and the trend and popularity of the brand’s Nautilus models, which have seen remarkable growth in the last few years, appeared to continue. There was some filtering down to the lower parts of the market which saw growth among entry-level watches in the £1,000-£5,000 range across the most collected brands and models although condition was again critical.

Within the pocket watch market, demand was strong where estimates were pitched conservatively. However, as with wristwatches, condition and rarity were key to the best results. Demand was most in evidence for highly decorative watches, especially those originally produced for the Chinese and Turkish markets. Fine watches with automata, exceptional Breguet watches and well-preserved early watches from the 17th century were keenly sought after at auction, with some exceptional prices achieved for the rarest pieces.

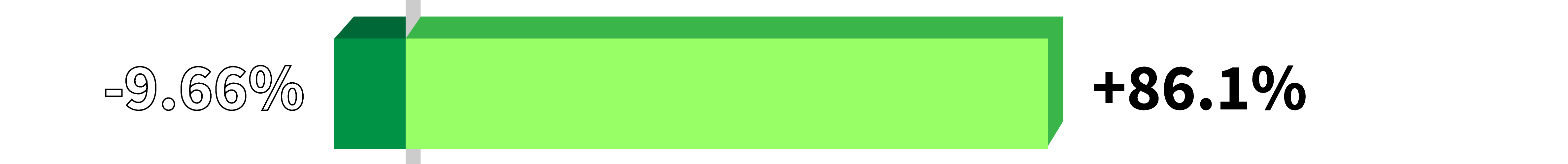

Classic Cars

Figures are based on All Sectors of AMR’s Classic Car Indexes, including Ferrari, Rolls Royce, BMW and 12 other marques.

2020 Classic Cars Overview

Classic car auctions managed to keep up and running throughout the first UK lockdown. For example, Bonham’s Goodwood event was cancelled, but the sale went ahead until the Sunday deadline. However, many clients were unwilling to spend if they couldn’t collect their cars and some enthusiasts chose to grab the opportunity to get on with home restorations. Parts suppliers remained open to cope with the demand.

As the year progressed Classic cars continued to sell well, but the initial excitement of buying something else to focus on and play with during difficult times seems to have been replaced by an air of caution as the lockdowns and virus outbreaks continued far longer than hoped. The market is still strong, but prices have settled down a bit, 1960s and earlier cars mostly easing down slightly, with 1970s on either stable or rising.

High risers include the Aston Martin DBS V8, finally recognised as a truly collectable Aston. Mk2 3.8 Jaguars in top condition have never been so sought after, bucking a general downward trend in collectable Jaguars. Most Ferraris except the late 1970s 308 GTB and GT4 are down.

Many agree that in times of crisis, thoughts turn to happier days of childhood and the surge in value of popular family classics like the Ford Anglia and Consul, BMW 2002, certainly supports the theory: and all the Triumph cars we chart, sports cars and convertibles, have seen a gentle rise – shifting the trend from years of relatively stagnant prices.

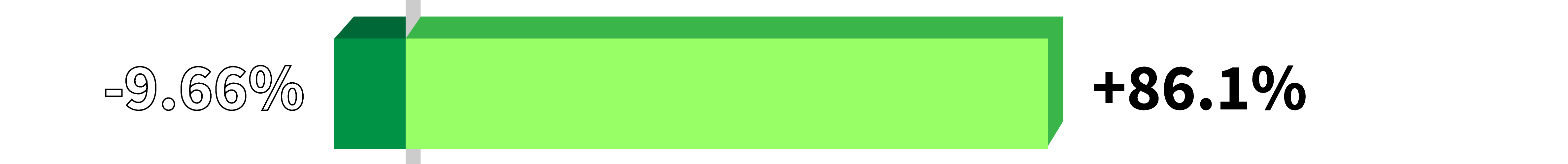

Classic Cars

Figures are based on All Sectors of AMR’s Classic Car Indexes, including Ferrari, Rolls Royce, BMW and 12 other marques.

2020 Classic Cars Overview

Classic car auctions managed to keep up and running throughout the first UK lockdown. For example, Bonham’s Goodwood event was cancelled, but the sale went ahead until the Sunday deadline. However, many clients were unwilling to spend if they couldn’t collect their cars and some enthusiasts chose to grab the opportunity to get on with home restorations. Parts suppliers remained open to cope with the demand.

As the year progressed Classic cars continued to sell well, but the initial excitement of buying something else to focus on and play with during difficult times seems to have been replaced by an air of caution as the lockdowns and virus outbreaks continued far longer than hoped. The market is still strong, but prices have settled down a bit, 1960s and earlier cars mostly easing down slightly, with 1970s on either stable or rising.

High risers include the Aston Martin DBS V8, finally recognised as a truly collectable Aston. Mk2 3.8 Jaguars in top condition have never been so sought after, bucking a general downward trend in collectable Jaguars. Most Ferraris except the late 1970s 308 GTB and GT4 are down.

Many agree that in times of crisis, thoughts turn to happier days of childhood and the surge in value of popular family classics like the Ford Anglia and Consul, BMW 2002, certainly supports the theory: and all the Triumph cars we chart, sports cars and convertibles, have seen a gentle rise – shifting the trend from years of relatively stagnant prices.

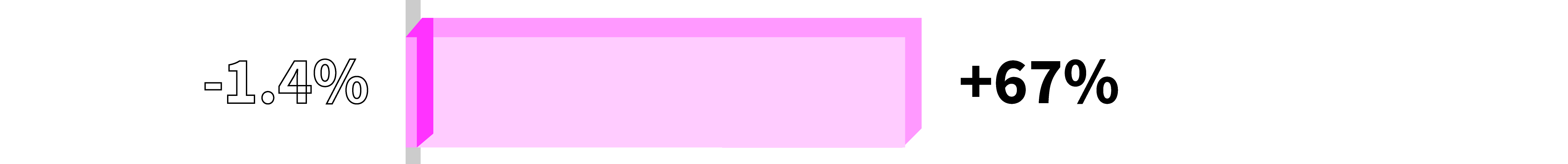

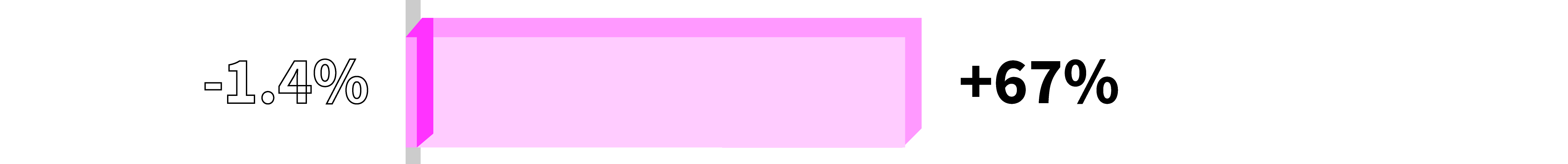

Hermès Handbags

Figures are based on AMR’s Hèrmes Birkin and Kelly Index.

2020 Hermes Handbags Overview

The auction market for Luxury Handbags rose 11.7% at the top four auction houses in the year to December 2020. Sotheby’s, who started selling Handbags in 2018, saw volumes of sales nearly triple in the same period. Christie’s, the market leader with over 50% share since 2015, consolidated their position at the top of the table with overall sales in the category reaching £19.7m across the year.

Rachel Koffsky, International Senior Specialist, Christie’s Handbags & Accessories, said; “The pandemic and subsequent lockdowns had a transformative effect on the auction and luxury world. The shift to online was expedited as many collectors, who were previously used to the in person experience, found that bidding online was an exciting way to engage at auction. Christie’s expanded digital capabilities, and clients that once relied on printed catalogues and in person viewings turned to digital viewing rooms, 360-degree photography and virtual meetings. Our luncheons were replaced with virtual panels, enabling us to connect with clients across the globe, from London to India in the same sitting. While boutiques and stores were closed, the secondary market experienced a surge of attention from clients of all ages, both new to vintage and experienced collectors alike. Some clients found that items in their closets and wardrobes were unworn, and used the quiet time to reassess their collections, whether reflecting on a new way of life or looking to make room for new purchases, while others looked to resale to fill the gap that the primary market had left whilst new products were unavailable.”

Hermès continued to be the most desirable handbag maker in the world with a new record set at auction in 2020. Christie’s Hong Kong sale on 27 November achieved a World Record for handbag sold at auction for a Rare Himalaya Kelly 25, when it sold for HK$3,375,000/ US$437,330. The Himalaya has been a collector favourite, and the previous world record, achieved at Christie’s in Hong Kong in November of 2017 was a Himalaya Birkin with 18k White Gold and Diamond Hardware. The Himalaya Kelly which now holds the record is adorned with palladium hardware, and reflects the evolving tastes of the top Hermès collectors in the world. The Himalaya Kelly has appeared less frequently than the Birkin, and the smallest size – the 25cm model – is considered the most desirable.

AMR’s Index of the wider Luxury Handbag category, which includes Chanel, Louis Vuitton alongside Hermès, was up +10.9% by the end of 2020.

Hermès Handbags

Figures are based on AMR’s Hèrmes Birkin and Kelly Index.

2020 Hermes Handbags Overview

The auction market for Luxury Handbags rose 11.7% at the top four auction houses in the year to December 2020. Sotheby’s, who started selling Handbags in 2018, saw volumes of sales nearly triple in the same period. Christie’s, the market leader with over 50% share since 2015, consolidated their position at the top of the table with overall sales in the category reaching £19.7m across the year.

Rachel Koffsky, International Senior Specialist, Christie’s Handbags & Accessories, said; “The pandemic and subsequent lockdowns had a transformative effect on the auction and luxury world. The shift to online was expedited as many collectors, who were previously used to the in person experience, found that bidding online was an exciting way to engage at auction. Christie’s expanded digital capabilities, and clients that once relied on printed catalogues and in person viewings turned to digital viewing rooms, 360-degree photography and virtual meetings. Our luncheons were replaced with virtual panels, enabling us to connect with clients across the globe, from London to India in the same sitting. While boutiques and stores were closed, the secondary market experienced a surge of attention from clients of all ages, both new to vintage and experienced collectors alike. Some clients found that items in their closets and wardrobes were unworn, and used the quiet time to reassess their collections, whether reflecting on a new way of life or looking to make room for new purchases, while others looked to resale to fill the gap that the primary market had left whilst new products were unavailable.”

Hermès continued to be the most desirable handbag maker in the world with a new record set at auction in 2020. Christie’s Hong Kong sale on 27 November achieved a World Record for handbag sold at auction for a Rare Himalaya Kelly 25, when it sold for HK$3,375,000/ US$437,330. The Himalaya has been a collector favourite, and the previous world record, achieved at Christie’s in Hong Kong in November of 2017 was a Himalaya Birkin with 18k White Gold and Diamond Hardware. The Himalaya Kelly which now holds the record is adorned with palladium hardware, and reflects the evolving tastes of the top Hermès collectors in the world. The Himalaya Kelly has appeared less frequently than the Birkin, and the smallest size – the 25cm model – is considered the most desirable.

AMR’s Index of the wider Luxury Handbag category, which includes Chanel, Louis Vuitton alongside Hermès, was up +10.9% by the end of 2020.

Prints/Multiples

Figures are based on AMR’s European & American Print 100 Index

2020 Prints/Multiples Overview

The growth of the auction Market for Prints and Multiples has outpaced all other categories of art over the last decade and despite lockdown restrictions the number of sales in 2020 was up on the previous year (+3.98%) However, the rate of growth in this market began to cool in 2019 with only the most iconic works continuing to excite collectors and 2020 proved no exception to the trend. Records set in 2020 were for prints by Banksy – ‘Girl with a Balloon’ and Shepherd Fairey – ‘Obama Hope’. Other records were set for a David Hockney iPad drawing which doubled its estimate and a work by Roni Horn – Still Water (The River Thames, for example).

Prints/

Multiples

Figures are based on AMR’s European & American Print 100 Index

2020 Prints/Multiples Overview

The growth of the auction Market for Prints and Multiples has outpaced all other categories of art over the last decade and despite lockdown restrictions the number of sales in 2020 was up on the previous year (+3.98%) However, the rate of growth in this market began to cool in 2019 with only the most iconic works continuing to excite collectors and 2020 proved no exception to the trend. Records set in 2020 were for prints by Banksy – ‘Girl with a Balloon’ and Shepherd Fairey – ‘Obama Hope’. Other records were set for a David Hockney iPad drawing which doubled its estimate and a work by Roni Horn – Still Water (The River Thames, for example).

Photography

Figures are based on AMR’s Contemporary Photography 50 Index

2020 Photography Overview

2020 proved to be a tough year for consigners of photographic works. Despite the number of sold lots at the major auction houses rising +6.75% on 2019, the increased volume was not matched by average values. Nevertheless, auction records were still set for works by long established icons of photography, including Richard Avedon – over £1m, Mario Testino – £180,000 , conceptual artist Bill Viola – £65,000, and modernist photographer Laszlo Moholy-Nagy with a sale reaching almost £100,000.

Photography

Figures are based on AMR’s Contemporary Photography 50 Index

2020 Photography Overview

2020 proved to be a tough year for consigners of photographic works. Despite the number of sold lots at the major auction houses rising +6.75% on 2019, the increased volume was not matched by average values. Nevertheless, auction records were still set for works by long established icons of photography, including Richard Avedon – over £1m, Mario Testino – £180,000 , conceptual artist Bill Viola – £65,000, and modernist photographer Laszlo Moholy-Nagy with a sale reaching almost £100,000.

Jewellery

Figures are based on All Setors of AMR’s Jewellery Indexes including Antique, Pearl, Contemporary and Gemstones.

2020 Jewellery Overview

Business was already muted as Tefaf Maastricht closed early, setting the tone for the rest of 2020. With flights difficult and the whole market just about frozen, Christies postponed their Geneva sales until the end of June. While it is not necessary to handle ordinary items, it is essential for good quality-coloured stones or pearls. The wealthiest collectors might have items flown to them but getting diamonds from vaults was hard and sending them complicated.

With the prospect of higher taxation compounding fears, the mood was not there and ultimately the top end of the market was not tested in 2020. Some good quality pearls were offered privately at prices well below ten years ago and diamond prices in general have been under pressure. Houses, yachts and holidays feature more widely on the shopping lists of the super-rich today and so some changes to the jewellery market may already be on the way.

Jewellery

Figures are based on All Setors of AMR’s Jewellery Indexes including Antique, Pearl, Contemporary and Gemstones.

2020 Jewellery Overview

Business was already muted as Tefaf Maastricht closed early, setting the tone for the rest of 2020. With flights difficult and the whole market just about frozen, Christies postponed their Geneva sales until the end of June. While it is not necessary to handle ordinary items, it is essential for good quality-coloured stones or pearls. The wealthiest collectors might have items flown to them but getting diamonds from vaults was hard and sending them complicated.

With the prospect of higher taxation compounding fears, the mood was not there and ultimately the top end of the market was not tested in 2020. Some good quality pearls were offered privately at prices well below ten years ago and diamond prices in general have been under pressure. Houses, yachts and holidays feature more widely on the shopping lists of the super-rich today and so some changes to the jewellery market may already be on the way.

Books

Figures are based on All Sectors of AMR’s Book Indexes including Architecture, History of Ideas, C19th Literature, Modern First Editions and others.

2020 Books Overview

The New York Antiquarian Book Fair and Bonhams book sale in London at the beginning of March proved to be the last face to face sales of 2020. Viewing in person is especially important for antiquarian books but the shift towards online sales and remote buying that has been underway for several years meant that auctioneers were well prepared for lockdowns, ‘behind close door’ sales, no viewing, and the demise of the printed catalogue.

Collectors had more disposable income (limited holidays, no theatre or opera, fewer meals out) and more time on their hands to trawl the web for books in 2020. The results have been increased bidder registrations and climbing hammer prices, that at times reach full retail level.

The top auction price for a printed book in 2020 was a Shakespeare First Folio, at $8.4m, there being no Audubon Birds fluttering around the salerooms this year. But many other titles, particularly in the £1,000-100,000 range, have broken auction records. Much of the literature market is up significantly, especially modern first edition and mid-Victorian classics. The history of thought continues to be a strong sector, these works often appealing to collectors who have made money in finance and technology. Both this category and architecture are quite thinly traded, but the latter has also seen slight growth for those titles that have appeared at auction in 2020.

Books

Figures are based on All Sectors of AMR’s Book Indexes including Architecture, History of Ideas, C19th Literature, Modern First Editions and others.

2020 Books Overview

The New York Antiquarian Book Fair and Bonhams book sale in London at the beginning of March proved to be the last face to face sales of 2020. Viewing in person is especially important for antiquarian books but the shift towards online sales and remote buying that has been underway for several years meant that auctioneers were well prepared for lockdowns, ‘behind close door’ sales, no viewing, and the demise of the printed catalogue.

Collectors had more disposable income (limited holidays, no theatre or opera, fewer meals out) and more time on their hands to trawl the web for books in 2020. The results have been increased bidder registrations and climbing hammer prices, that at times reach full retail level.

The top auction price for a printed book in 2020 was a Shakespeare First Folio, at $8.4m, there being no Audubon Birds fluttering around the salerooms this year. But many other titles, particularly in the £1,000-100,000 range, have broken auction records. Much of the literature market is up significantly, especially modern first edition and mid-Victorian classics. The history of thought continues to be a strong sector, these works often appealing to collectors who have made money in finance and technology. Both this category and architecture are quite thinly traded, but the latter has also seen slight growth for those titles that have appeared at auction in 2020.

Coins

Figures are based on All Sectors of AMR’s Coin Indexes including English Gold and Silver, Hammered & Milled coins.

Coins

Figures are based on All Sectors of AMR’s Coin Indexes including English Gold and Silver, Hammered & Milled coins.

All of the figures on this page provide a general picture of the market for each category*. The list is just a fraction of the indexes we offer via our ‘Create an Index’ service. All usage and licensing is subject to AMR copywright. For more information on access to our service or licensing, contact us.

Tell us which data you need

Tell us which data you need

*Indexes have been compiled for research purposes and AMR does not warrant their use for investment purposes. See Terms and Conditions.

Copyright © 2021 Art Market Research, All Rights Reserved

Copyright © 2021 Art Market Research, All Rights Reserved